How Gold Loan Interest Is Calculated (With Example)

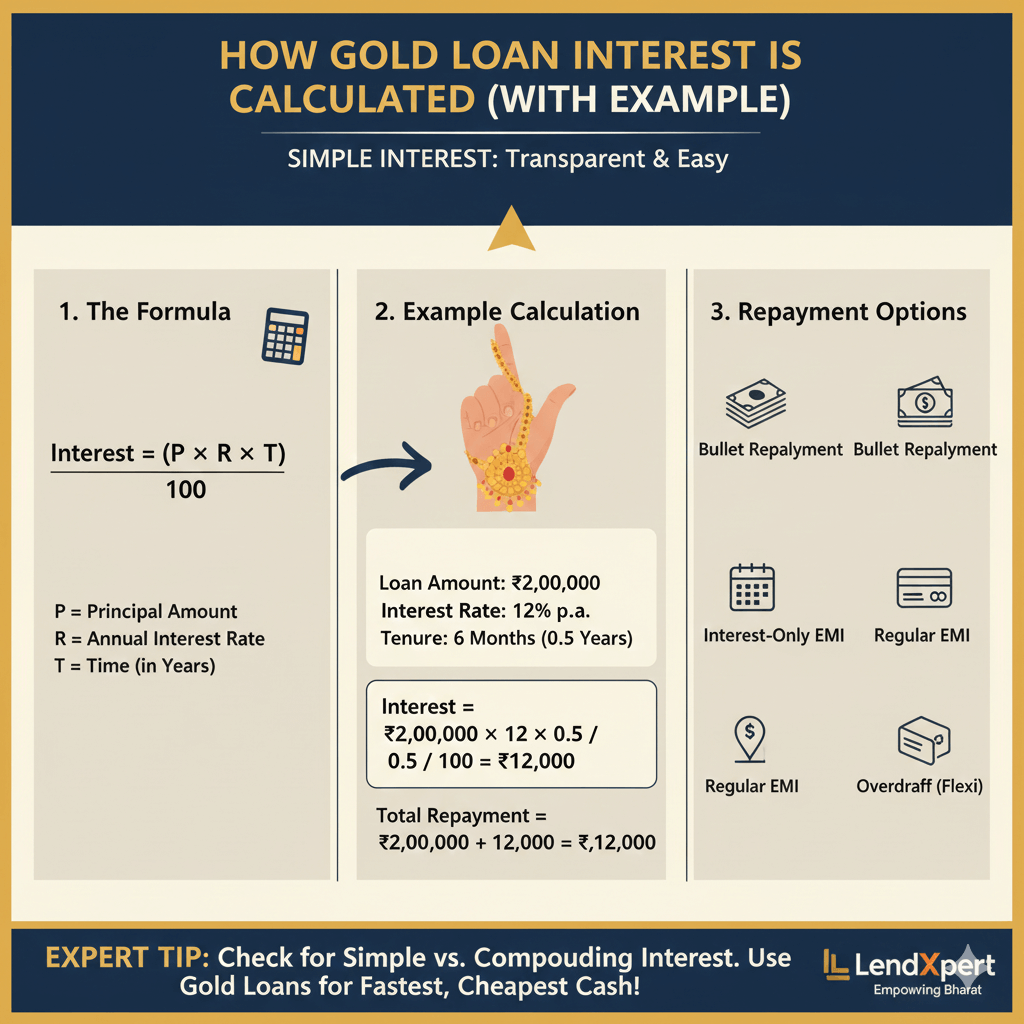

Understanding how gold loan interest is calculated can help you make informed decisions about borrowing. Gold loans typically use simple interest calculation, which is straightforward and transparent.

Gold loan interest is calculated based on:

- Loan amount

- Interest rate

- Loan tenure

Unlike personal loans, gold loans usually follow simple interest rather than compound interest.

Example Calculation

Let's calculate the interest for a sample gold loan:

- Loan Amount: ₹2,00,000

- Interest Rate: 12% per annum

- Tenure: 6 months

Interest = (2,00,000 × 12 × 6) / (100 × 12) = ₹12,000

Total repayment = ₹2,12,000

Factors Affecting Gold Loan Interest

- Gold purity (22K gets the best rates)

- Loan tenure

- LTV ratio

- Repayment option

Ways to Reduce Interest

- Choose a short tenure

- Pay interest monthly

- Avoid loan extensions

Why LendXpert Gold Loans Are Better

- Transparent pricing

- No hidden charges

- Same-day processing

- Secure vault storage