Gold Loan vs Personal Loan: Which Is Better for Immediate Cash Needs?

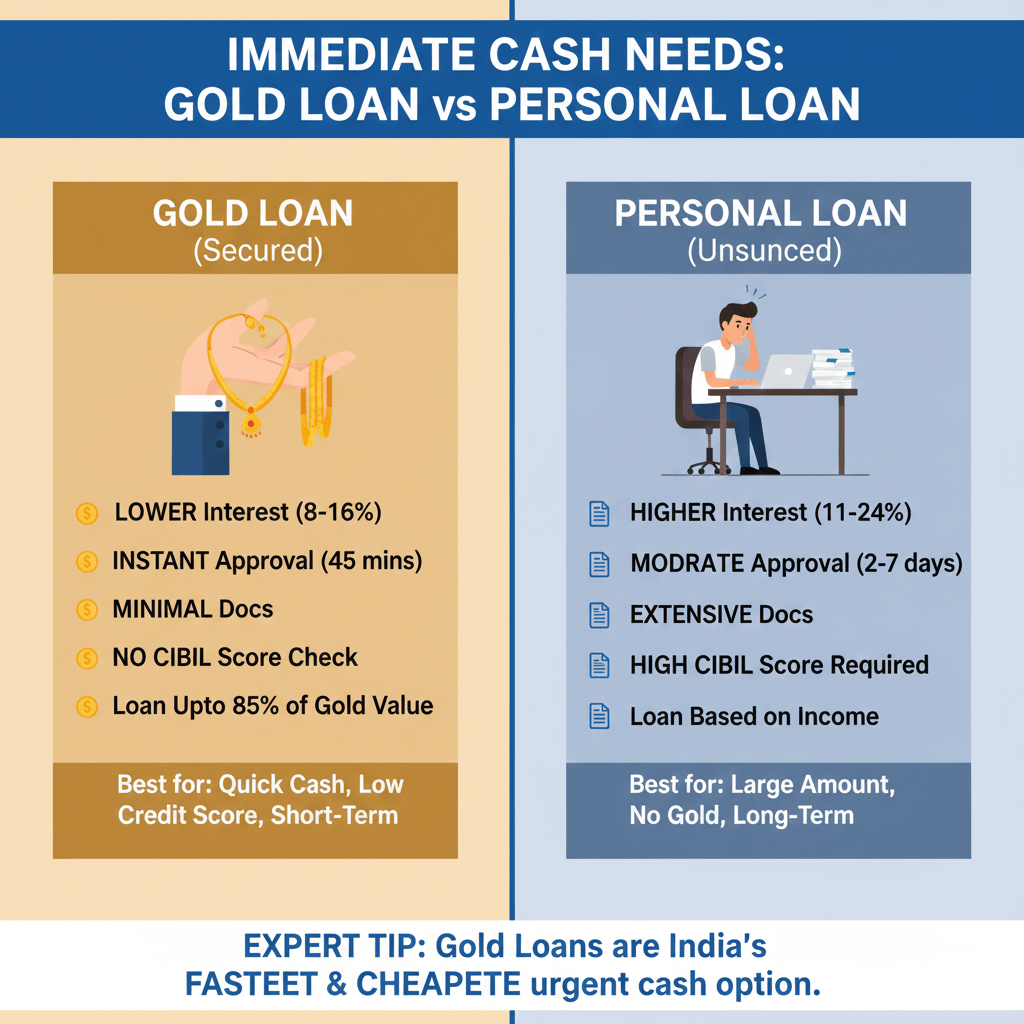

When you need urgent funds, choosing between a Gold Loan and a Personal Loan can be confusing. Both serve different purposes and come with different costs. Understanding the difference can save you money and stress.

Let's break it down simply.

What Is a Gold Loan?

A gold loan is a secured loan where you pledge gold jewelry as collateral. The loan amount depends on:

- Weight of gold

- Purity (karat)

- Current gold price

Advantages include lower interest rates, faster approval, and minimal documentation.

What Is a Personal Loan?

A personal loan is unsecured, meaning no collateral is required.

Disadvantages include higher interest rates, strict eligibility, and longer approval time.

Gold Loan vs Personal Loan Comparison

| Feature | Gold Loan | Personal Loan |

|---|---|---|

| Interest Rate | Lower | Higher |

| Processing Time | Same day | 3-7 days |

| Documents | Minimal | Extensive |

| Credit Score | Not critical | Very important |

| Loan Amount | Based on gold | Based on income |

When Should You Choose a Gold Loan?

- You need urgent cash

- You own gold jewelry

- You want lower EMI

- You don't want credit score issues

When Personal Loan Makes Sense

- No gold available

- Long-term funding

- Higher loan amount required

Expert Tip

Gold loans are one of the cheapest and fastest loans in India, especially for small business owners and families.

Need Instant Gold Loan?

Get your gold valued for FREE, same-day disbursal, transparent charges.