MSME Loans Explained: A Complete Guide for Small Business Owners

MSMEs (Micro, Small, and Medium Enterprises) are the backbone of India's economy, yet access to finance remains a significant challenge for many small business owners. MSME loans provide essential funding to help businesses grow and thrive.

MSME loans help in:

- Working capital

- Business expansion

- Equipment purchase

- Cash flow management

Types of MSME Loans

- Working Capital Loan

- Term Loan

- Machinery Loan

- Business Expansion Loan

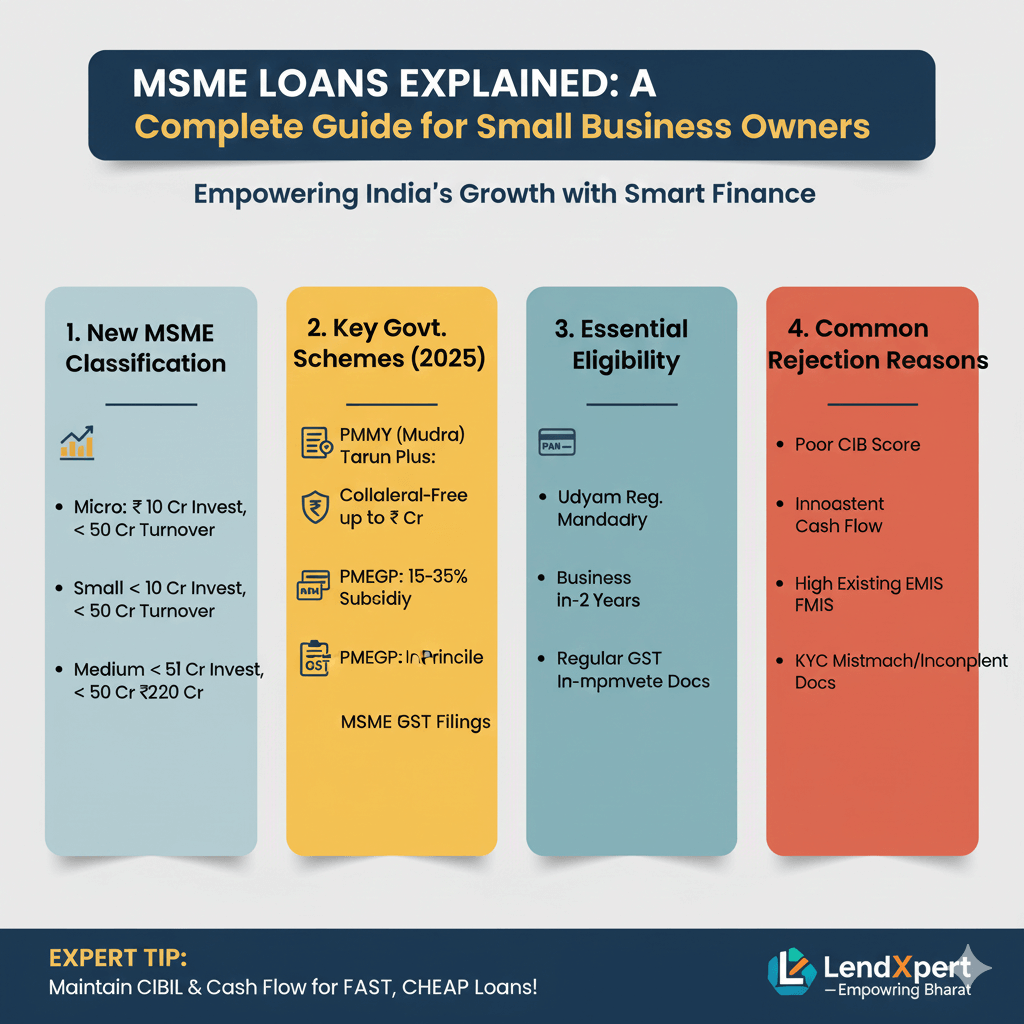

Eligibility Criteria

- Business vintage: 1-3 years

- Regular income

- Basic KYC

- Bank statements

Common Reasons for Rejection

- Poor CIBIL score

- Incomplete documents

- High existing EMI

- Unstable business income

How LendXpert Helps MSMEs

- Fast approvals

- Minimal documentation

- Flexible repayment

- Local support team

Grow your business with confidence.