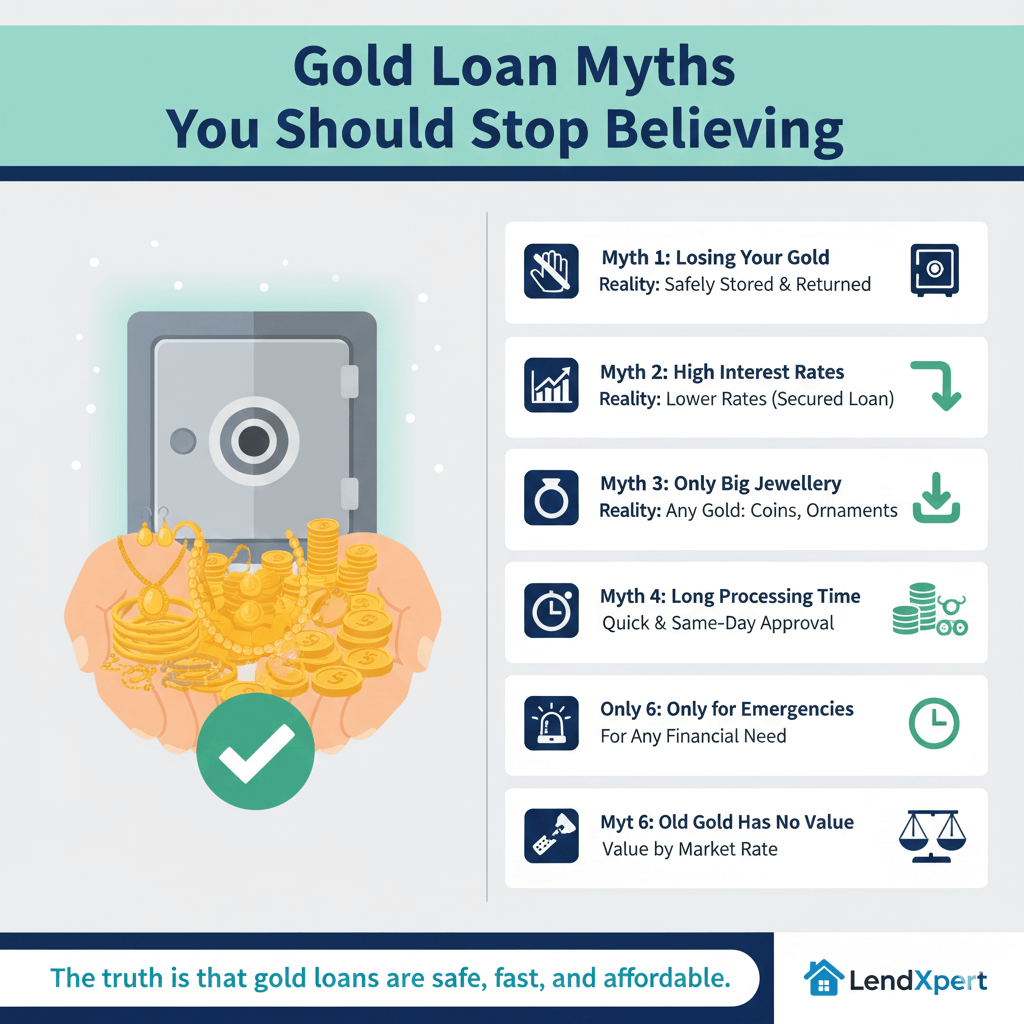

Gold Loan Myths You Should Stop Believing

Gold loans are a popular financing option in India, but many misconceptions prevent people from taking advantage of them. Let's debunk some common myths and reveal the truth about gold loans.

Myth 1: Gold Loan Means Losing Your Gold

Reality: Your gold is safely stored in secure vaults and returned to you after full repayment. It's not lost; it's just held as collateral.

Myth 2: Interest Rates Are Very High

Reality: Gold loans typically have lower interest rates compared to personal loans or credit cards. They are one of the most affordable secured loan options available.

Myth 3: Only Big Jewellery Accepted

Reality: Small ornaments, chains, and even gold coins are eligible. The loan amount depends on the gold's weight and purity, not its size.

Myth 4: Long Processing Time

Reality: With modern NBFCs like LendXpert, gold loan approval can happen the same day. The process is quick and hassle-free.

Myth 5: Gold Loans Are Only for Emergencies

Reality: While great for emergencies, gold loans can also be used for business expansion, education, medical expenses, or any other financial need.

Myth 6: Old Gold Has No Value

Reality: The value is determined by current market rates, not the age of the gold. Even inherited or old jewelry can fetch good loan amounts.

The truth is that gold loans are safe, fast, and affordable. They provide a reliable way to access funds without selling your gold.