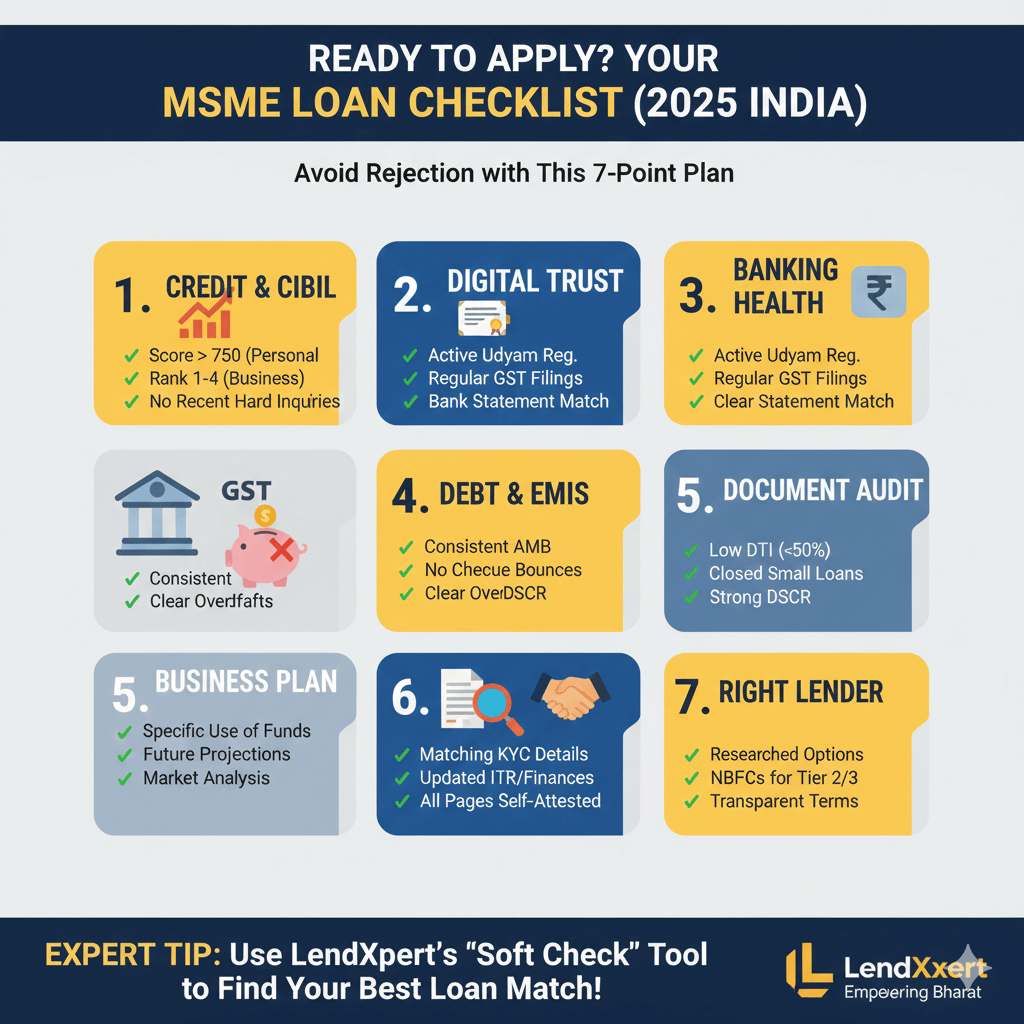

7 Reasons MSME Loan Applications Get Rejected (And How to Avoid Them)

Many MSME owners apply for loans but face rejection without clear reasons. Understanding why applications fail can dramatically improve your chances of approval.

Here are the 7 most common reasons MSME loans get rejected and how you can avoid them.

1. Poor Credit Score

Banks and NBFCs rely heavily on CIBIL scores.

Below 650 is considered high risk, while above 700 offers better approval chances.

Tip: Clear overdue EMIs before applying.

2. Incomplete Documentation

Missing GST returns, ITRs, or bank statements often lead to rejection.

Fix: Keep last 12 months bank statements and KYC ready.

3. Low Business Turnover

Lenders assess repayment capacity.

Solution: Apply for an amount aligned with your actual turnover.

4. High Existing Debt

Too many EMIs reduce eligibility.

Tip: Close small loans before applying.

5. Poor Banking History

Frequent cheque bounces or overdrafts create red flags.

6. No Proper Business Proof

Unregistered or cash-only businesses struggle.

7. Applying to the Wrong Lender

Every lender has different criteria.

NBFCs like LendXpert offer flexible MSME loans, especially for Tier 2 & 3 cities.

Need help getting approved?