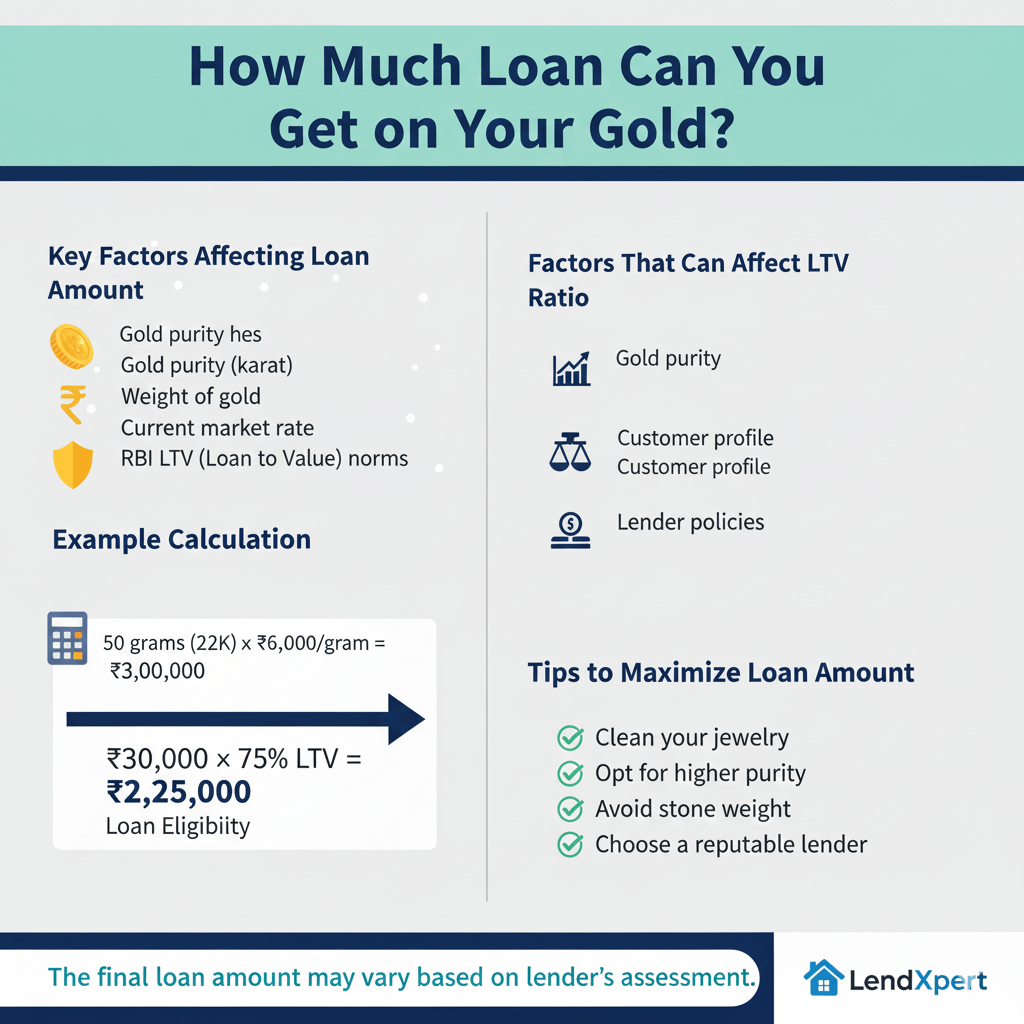

How Much Loan Can You Get on Your Gold?

The loan amount you can get on your gold depends on several key factors. Understanding these factors can help you maximize your borrowing potential.

Key Factors Affecting Loan Amount

- Gold purity (karat)

- Weight of gold

- Current market rate

- RBI LTV (Loan to Value) norms

How Loan Amount Is Calculated

The loan amount is calculated as a percentage of your gold's market value, known as the Loan to Value (LTV) ratio. RBI guidelines typically allow up to 75% of the gold's value as loan amount for NBFCs.

Example Calculation

Let's calculate for 22K gold weighing 50 grams:

- Current market value per gram: ₹6,000

- Total value: 50 × 6,000 = ₹3,00,000

- LTV ratio: 75%

- Loan eligibility: ₹3,00,000 × 0.75 = ₹2,25,000

Factors That Can Affect LTV Ratio

- Gold purity: Higher purity (24K) may get better LTV

- Customer profile: Good credit history may allow higher LTV

- Lender policies: Different NBFCs may have varying LTV ratios

Tips to Maximize Loan Amount

- Clean your jewelry to ensure accurate weight measurement

- Opt for higher purity gold if possible

- Avoid including stone weight in gold weight

- Choose a reputable lender with competitive LTV ratios

Remember, the final loan amount may vary based on the lender's assessment and current market conditions.