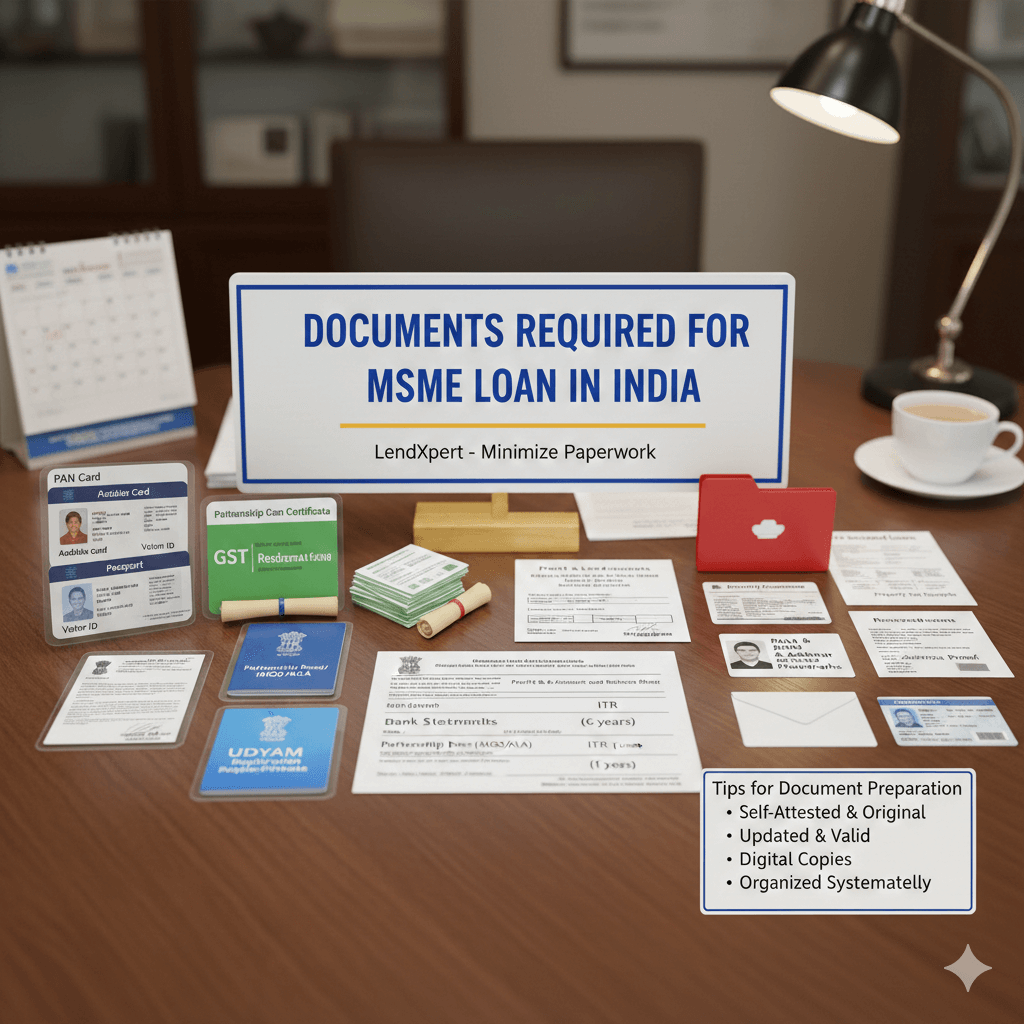

Documents Required for MSME Loan in India

Applying for an MSME loan in India requires submitting various documents to verify your identity, business legitimacy, and financial stability. The exact requirements may vary by lender and loan type, but here are the commonly required documents.

Basic Identity and Address Documents

- PAN Card (mandatory for all applicants)

- Aadhaar Card or other address proof

- Passport or Voter ID (alternative identity proof)

Business Registration Documents

- GST Registration Certificate (if applicable)

- Business License or Registration Certificate

- Partnership Deed or MOA/AOA (for companies)

- UDYAM Registration Certificate

Financial Documents

- Bank statements (last 6-12 months)

- GST Returns (last 2 years)

- Income Tax Returns (ITR) for last 2 years

- Profit & Loss Account and Balance Sheet

Additional Documents for Secured Loans

- Property documents (if using property as collateral)

- Rent agreement (if business premises are rented)

- Property tax receipts

Documents for Proprietor/Partners/Directors

- Personal PAN and Aadhaar

- Address proof

- Passport-size photographs

Tips for Document Preparation

- Ensure all documents are self-attested and original

- Keep documents updated and valid

- Prepare digital copies for online applications

- Organize documents systematically for easy submission

Different lenders may have specific requirements, so it's advisable to check with the lender beforehand. At LendXpert, we strive to minimize paperwork and make the process as simple as possible.